Cindy Le, Research Associate, WES

Business and management programs are top draws for U.S.-bound students from around the world. In fact, as a field of study, business programs regularly beat out the next leading contender for international enrollments in the U.S. – engineering – every year from 2000/01 through 2014/15.

However, international enrollments in U.S. business programs have been slipping in recent years, and fell to second place behind engineering in 2015/16. At the same time, business schools in other countries have begun to see rising enrollments.

The stakes are high for programs in the U.S. Fully 51 percent of the enrollments in traditional two-year programs – the dominant business program offered in the United States – are international.[1]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx Moreover, international students have been viewed as a potential antidote to a broader drop-off in enrollments and interest more generally.

As the website Poets&Quants recently noted, “full-time, two-year MBA programs in the United States have seen declines in application volumes… [for] the third straight year.”

This article examines the underlying factors at play in declining international interest, and offers suggestions to help U.S. institutions mitigate further softening.

Sizing the Decline

The U.S. remains the preferred MBA study destination for full-time international students.reported in 2015 [2].

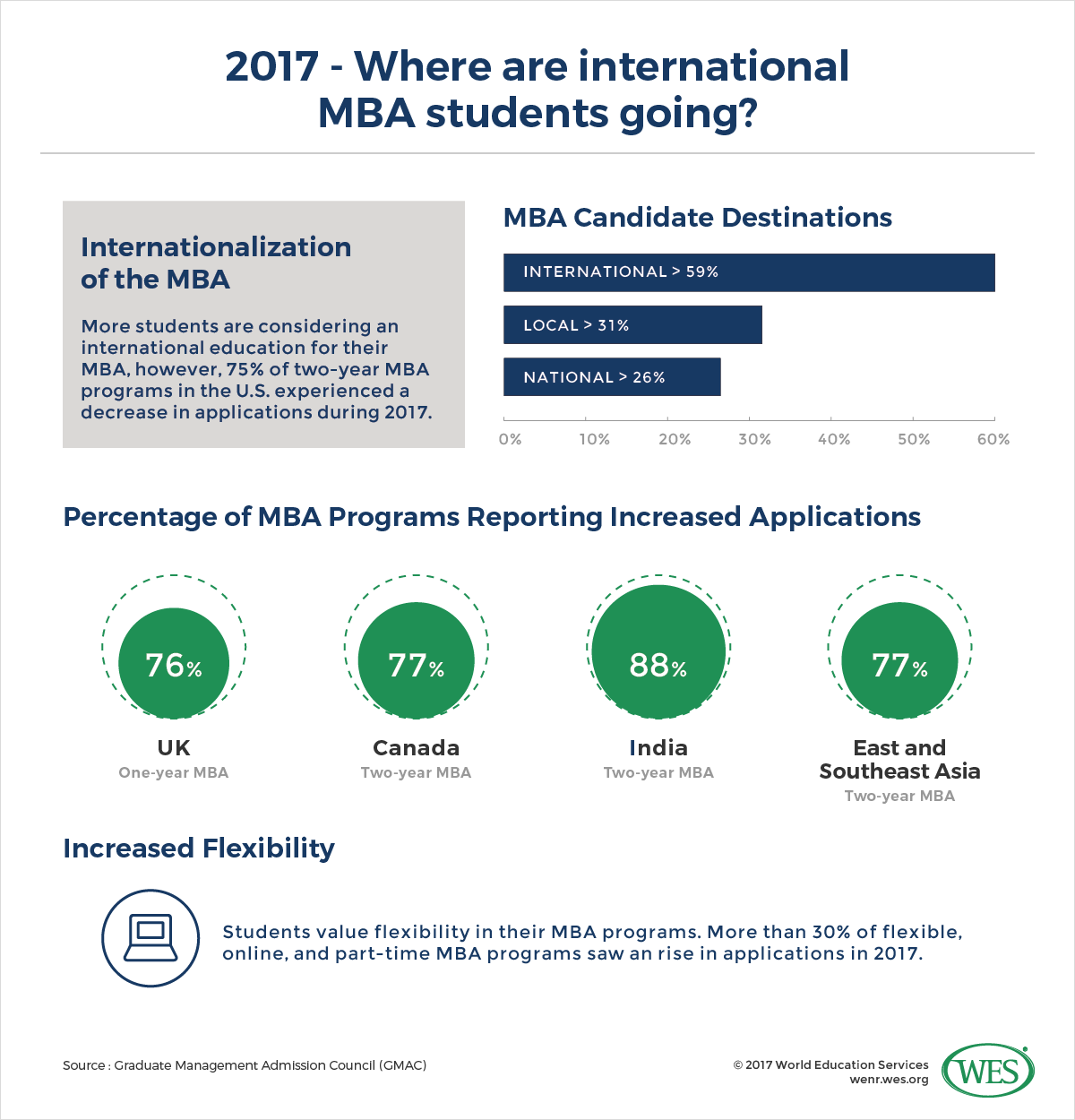

There are other signs of softening interest as well. A second 2017 GMAC survey, released in September, found that applications from international students to traditional two-year MBA programs fell for 75 percent of U.S. business schools. [3] “The BBC [4].

Other countries, meanwhile, are seeing increased student interest. Per GMAC’s Application Trends Survey Report 2017, “Programs in Europe, East and Southeast Asia, and India were more likely [than those in the U.S.] to report growth in international applicants.” Similarly, continued the report, “the majority … in Europe and Canada reported increased volume from international candidates.”[4]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx In 2017:

- 76 percent of one-year MBA programs in Europe reported growth.[5]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx Full-time two-year MBA programs in countries besides the U.S. have seen large increases as well.

- 77 percent of full-time two-year MBA programs in East and Southeast Asia reported an increase in applications, as did 77 percent of programs in Canada, and 88 percent of programs in India.[6]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx

In fact, international business applicants are now twice as likely as they were in earlier years [5]to apply to schools outside of the United States.

That said, there is room for continued growth, if institutions are savvy about how to retool their programs to attract new students. Notably, the broader pool of prospective business school students who plan to study outside their country of residence has expanded from 44 to 59 percent between 2009 and 2017, even as interest in the traditional MBA has declined.[7]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx With more students intending to study internationally, the question is where they will choose to go and what programs they will choose.

Challenge 1: The Rise of Competing Programs and New School Models

Specialized business programs and alternate delivery models are drawing the interest of international students who might otherwise have considered a U.S.-based MBA. According to GMAC’s most recent prospective students’ survey:

“The percentage of candidates considering only business master’s degrees — such as Master of Finance, Master of Accounting, and Master in Management (MiM) — … increased from 15 percent in 2009 to 23 percent in 2016. This rise in interest has been particularly strong among candidates from East and Southeast Asia and Western Europe, where now more than two in five candidates report considering only these program types.”

During the same period, the number of candidates interested only in MBA programs fell from 52 to 49 percent.[8]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx

Most of the specialized non-MBA business degrees that have begun to attract increased student interest require a shorter time investment [6] than traditional MBAs. For instance, a Master in Management (MiM) degree – also known as Masters in International Business, Masters in General Management, Masters in Business and Economics, or Masters in Professional Studies [7] – takes only 10 to 18 months to complete.

Most of the top-ranked MiM programs are in Europe, where the program originated. However, several American institutions – Cornell, Northwestern, Babson College, Duke, University of Virginia, and University of Michigan – have either recently launched or are planning to launch MiM programs [8].

That the programs are, from both an employer and student perspective, a viable alternative to MBAs seems clear. Students tend to be younger and have less work experience than traditional MBA students, but they still recoup significant benefits after graduation. According to the Financial Times [9], “The minority of students who worked before their MiM … increase their pay by an average of $30,000 a year after completing their degree.”

The scale of this increase is likely to have particular appeal for the relatively young students who tend to be drawn to MiMs. “For many [Masters in Management students] the true value of the degree is being able to aspire to secure well-paid jobs so soon out of formal education. Unlike MBA students, who have usually worked for a few years before applying to business school, most MiM students arrive on campus fresh from undergraduate studies. This means MiM students are less concerned about getting a highly paid job than finding a position in the first place.”

Search for More Flexibility: Online and Part-time MBA Programs

With the advent of online and part-time MBA programs, students are now able to choose from more flexible degree options. These programs tend to be more cost-friendly, in addition to lowering the opportunity cost, as students can simultaneously work while earning their degree. Online programs have the added benefit of eliminating relocation costs.

According to GMAC data 54 percent of part-time lockstep MBA programs reported an increase in applications in 2017, and 34 percent of part-time self-paced programs reported growth. 33 percent of flexible MBA programs, which combine both full-time and part-time options, have also experienced an increase in applications. Finally, 47 percent of online MBA programs experienced an increase. In 2016, the Association of MBAs’ (AMBA) accreditation of the first online MBA program, hosted by the University of Birmingham, raised the profile of online programs for potential students.[9]https://www.businessbecause.com/news/mba-distance-learning/4650/mba-jobs-online-mba-students-global-employers

Recommendation 1: Innovate Programs and Delivery Models

Schools willing to expand their offerings to online or part-time programs will likely attract additional students who are searching for more flexible options. GMAC’s study of the motivations of business schools candidates found that students who already have an established career are most likely to value flexible options such as part-time and online options, weekend classes, or a mixture of in-person and online classes.[10]https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/beyond-demographics-connecting-with-the-core-motivations-of-business-school-candidates.aspx

Institutions may also consider the addition of shorter business degrees, such as the Masters in Management, which appeal to a different demographic (typically younger) and are currently drawing increased interest among international students.

Challenge 2: Cost (Tuition x Time to Degree x Years Out of the Workforce = Cost)

In 2016, the median cost of a standard two-year MBA degree from a top-25, U.S.-based business school – including tuition, living costs, and more – was $171,000 [10]. A handful of schools, including NYU’s Stern School of Business, Stanford’s Graduate School of Business, the University of Pennsylvania’s Wharton School, and Columbia’s Business School, had even higher total costs, each offering a degree that ultimately cost more than USD $200,000.[15] [11] Meanwhile, a one-year degree from INSEAD, a top-ranked European business school with campuses in Asia, and the Middle East, cost between USD $126,000 and USD $129,000 [12] in 2017.

Such costs are a deterrent for many students: A 2016 Graduate Management Admission Council (GMAC) survey of more than 11,000 prospective MBA candidates, found that lack of funds and the prospect of debt posed significant barriers to entry for many.[11]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx As GMAC noted in a report about the survey, “Though U.S. universities have the strongest reputation for providing a quality business education, a growing share of candidates seek other destinations that offer more affordable and welcoming options.”

For price-sensitive populations of students who tend to enroll in MBA programs in high numbers – for instance students from India and Vietnam – the cost/benefit analysis may be especially daunting. Data from the Institute of International Education show that between 2009/10 and 2015/16, enrollments of Indian students in master’s level programs at U.S. institutions fell from 15 percent of all master’s student enrollments to 10 percent. Enrollments among Vietnamese master’s level students seeking business degrees fell from 40 percent to 30 percent in the same period.

The high cost of an American MBA is compounded by time: A typical MBA in the U.S. is two years. European programs, by contrast, typically last only one year.[18] [13] The challenge for students choosing between one and two-year programs goes beyond price tag. It also includes the opportunity cost of leaving the work force – equivalent to two years of foregone salary.[19] [14],[21] [15]The time it takes to earn a degree in the U.S., long an area of concern among many business school administrators, seems to finally be pushing a critical mass of students to seek alternatives to the traditional two-year program. In 2017, GMAC reported that 76 percent of one-year MBA programs in Europe reported growth in applications (90 percent of them from international students), while applications fell for 64 percent of two-year full-time MBA programs in the US.[13]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx On the strength of this trend, the U.K., instead of the U.S., has become the most preferred international study destination for Western Europeans seeking MBAs –the first and only time that has happened since GMAC began collecting data about global business program enrollments.[14]Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx

One-year MiM and other non-MBA programs again offer relief. As noted by the Financial Times [9], MiM students can “recoup the tuition fees and living expenses incurred during their education with [their] first year’s pay packet, according to GMAC’s calculations. A graduate of a typical two-year MBA course, by contrast, would take three and a half years to recover their study costs.” Because funding is one of the largest concerns for students, universities should seek to address potential students’ financial concerns. One key focus should be lowering unduly high tuitions. Given the fact that full-time MBA programs are often loss leaders [16] for universities, any steps to lower tuition should be considered in conjunction with other strategies – e.g., implementing revenue generating programs such as open enrollment executive education programs or short-term courses that focus on a specific industry or skill set – but are nevertheless worth consideration. Others strategies for attracting enrollments include offers of additional scholarships, and the provision of funding advice that can help international students understand and manage the complete costs of their education. Another way to help address students’ financial concerns is to help them understand, in very concrete terms, the return on investment that they can expect from their degrees (ROI). Schools should seek to demonstrate the ROI for specific programs in order for potential students to understand why they should consider one program over another. This includes sharing data about potential job earnings and prospects, including information and data from previous graduating classes. If institutions have difficulties demonstrating their value, they need to reconsider how they operate in order to increase the ROI for students, whether through blended learning techniques, reducing the course load and time to graduate, increasing scholarship dispersal, or introduction of new, more targeted programs. Even as international enrollments in U.S. business schools are declining, students are showing keen interest in new destinations in Western Europe, Canada, Australia, and New Zealand.[15]http://timesofindia.indiatimes.com/city/mumbai/more-students-keen-on-mba-abroad-but-will-skip-us-uk/articleshow/58742723.cms Consider: Even China, the top sender of MBA students to the United States and Canada, and the second leading sender to Western Europe behind India is on the rise as a destination. As the Financial Times reported last month, “Historically, the Chinese student diaspora has headed abroad to study, guided by a belief that European or American MBAs were superior to those from Chinese institutions. But … increasing numbers of [Chinese] institutions have gained international accreditation that qualifies them for global rankings. “The Shanghai-based China Europe International Business School (Ceibs [25]) MBA course was ranked [18] 11th best in the world by the Financial Times this year, up from 17th in 2016 and the highest of five Chinese schools in the top 100. It became the first Chinese institution to receive European Foundation for Management Development (EFMD) accreditation in 2004. Now, 20 Chinese schools have achieved the standard, according to David Asch, EFMD’s director of quality services. “‘The west has had a good run with Chinese students for the last 15 to 20 years, but it’s going to come to an end,” Mr. Asch [said]. “The jobs network is key.’” Understanding regional differences in motivation can help institutions to fine tune their recruitment and outreach strategies, emphasizing their career services support or work placement to recruit students from different countries. For instance: ReferencesRecommendation 2: Address Financial Concerns

Challenge 3: The Rise of Other Destinations

Recommendation 3: Cater to Regional Differences and Build Alumni Networks

↑1, ↑3, ↑4, ↑5, ↑6, ↑11 Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx

↑2 http://indiatoday.intoday.in/education/story/mba-degree/1/982257.html

↑7, ↑8, ↑12, ↑13, ↑14, ↑18, ↑19, ↑20 Application Trends Survey Report 2017, Graduate Management Admission Council https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/2017-application-trends-survey-report.aspx

↑9 https://www.businessbecause.com/news/mba-distance-learning/4650/mba-jobs-online-mba-students-global-employers

↑10 https://www.gmac.com/market-intelligence-and-research/research-library/admissions-and-application-trends/beyond-demographics-connecting-with-the-core-motivations-of-business-school-candidates.aspx

↑15 http://timesofindia.indiatimes.com/city/mumbai/more-students-keen-on-mba-abroad-but-will-skip-us-uk/articleshow/58742723.cms

↑16 http://www.prnewswire.com/news-releases/german-international-business-schools-on-the-rise-says-schiller-international-university-300482061.html

↑17 http://www.canadianbusiness.com/lists-and-rankings/best-mba-programs/mba-schools-in-canada-for-international-students/