Top Emerging Markets for International Student Recruitment

By Yuanyuan Fang, Megha Roy, Alejandro Ortiz, Research & Advisory Services, WES

The number of international students from just a few countries on major U.S. campuses has increased to such a level that headlines such as “The University of China at Illinois” have been appearing in major education news media with increasing frequency. In response, and as international students continue to flock to the U.S., top universities such as Harvard and Yale have started to focus on diversifying their student bodies by attracting students of more varied backgrounds from a broader base of countries, and regardless of their financial means.

While there has been increased interest in recruiting international students, many institutions still pay too little attention to the diversity of their student bodies. In response, WES released a research report in 2012 with the goal of encouraging institutions to expand their recruitment horizons and to prepare for new and emerging markets. Given the complexity of navigating these emerging markets and the time and effort it takes to cultivate them, schools must be forward-thinking. Therefore, one of the elements of a sustainable international student enrollment strategy is to be proactive in identifying and cultivating a diverse portfolio of source countries.

This follow-up study identifies key emerging markets for international student recruitment through 2018 and seeks to inform higher education institutions’ strategic planning by giving them a deeper understanding of future international student recruitment markets.

This report addresses two main questions:

- Beyond the traditional markets (China, India, and South Korea), what are likely to be the top four emerging markets for recruiting international students in the next three years, and what exactly makes these promising recruitment markets?

- What are the most effective strategies and practices for recruiting international students from these emerging markets?

Methodology

New target markets for recruitment activities are often based on anecdotal evidence. To help take the guesswork out of the process, we designed this current study based on data and research. To determine the top emerging markets for international student recruitment over the next three years, we used a mixed-methods research design to collect data from several primary and secondary sources, and cross-validated the findings in three phases:

- Secondary research

- Quantitative research (survey)

- Qualitative research (interviews)

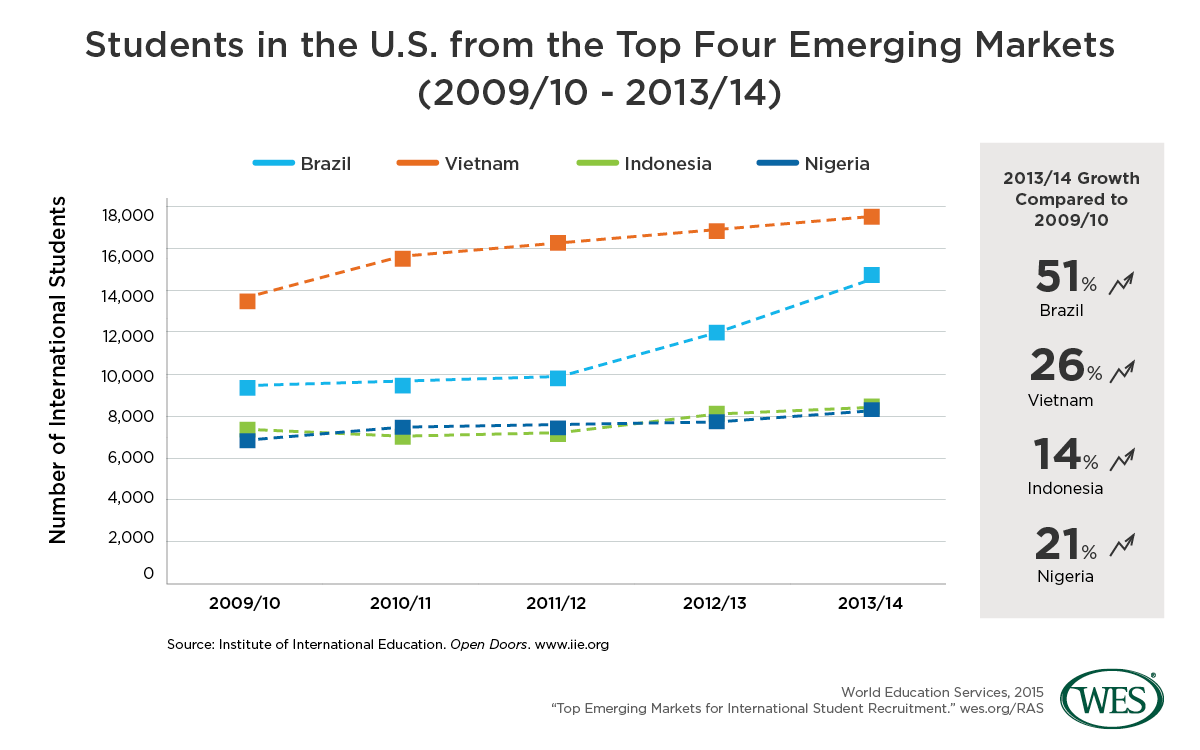

In the first phase, the selection of countries was based on the average percentage change of international students from 2010/11 to 2013/14 (IIE Open Doors) and an in-depth literature review of these fastest-growing countries. The final four emerging markets were based on the results of an online survey of international student recruitment/enrollment professionals, accompanied by phone interviews designed to gather information on best practices for recruiting in these specific markets.

In order of importance, survey respondents to the WES survey identified Brazil, Vietnam, Indonesia, and Nigeria as the top four emerging markets to watch over the next three years. In the past five years, these countries have shown substantial increases in the number of students studying in the U.S., alongside stable economic growth.

The Top Four Emerging Markets: Best Practices and Implications for Recruitment Strategies

1. Brazil

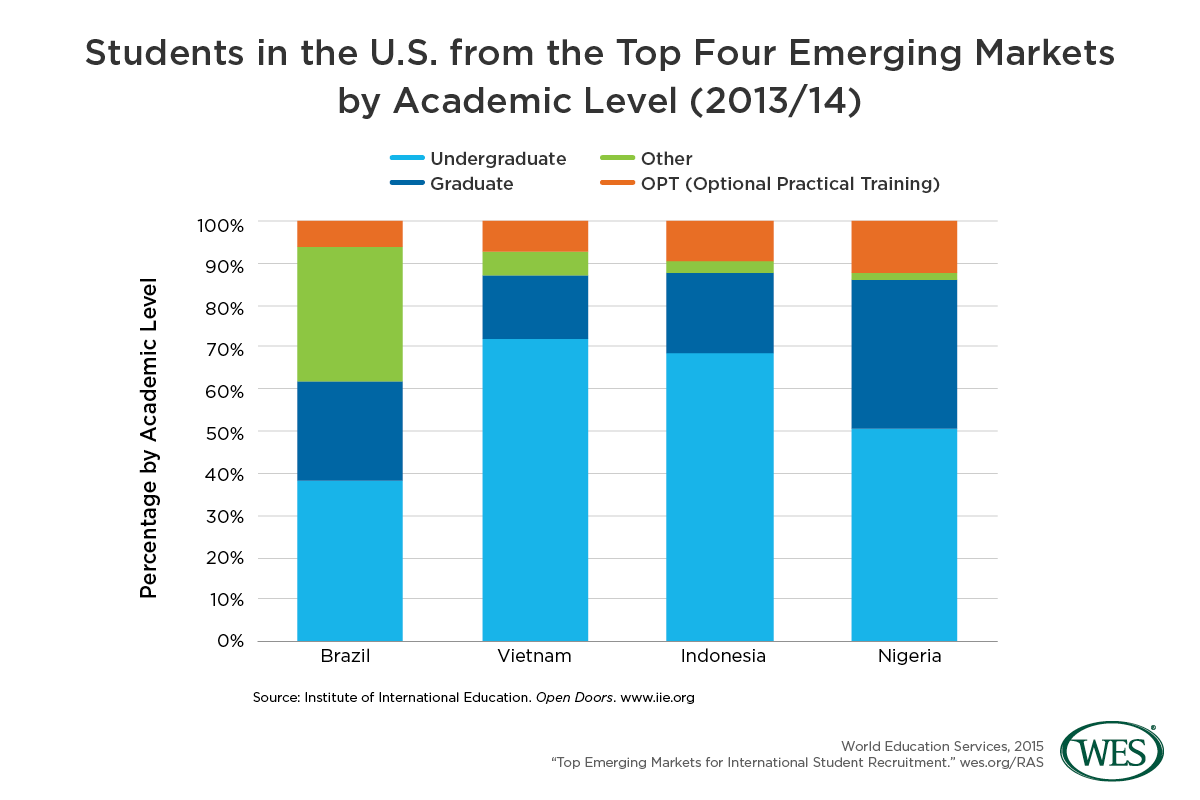

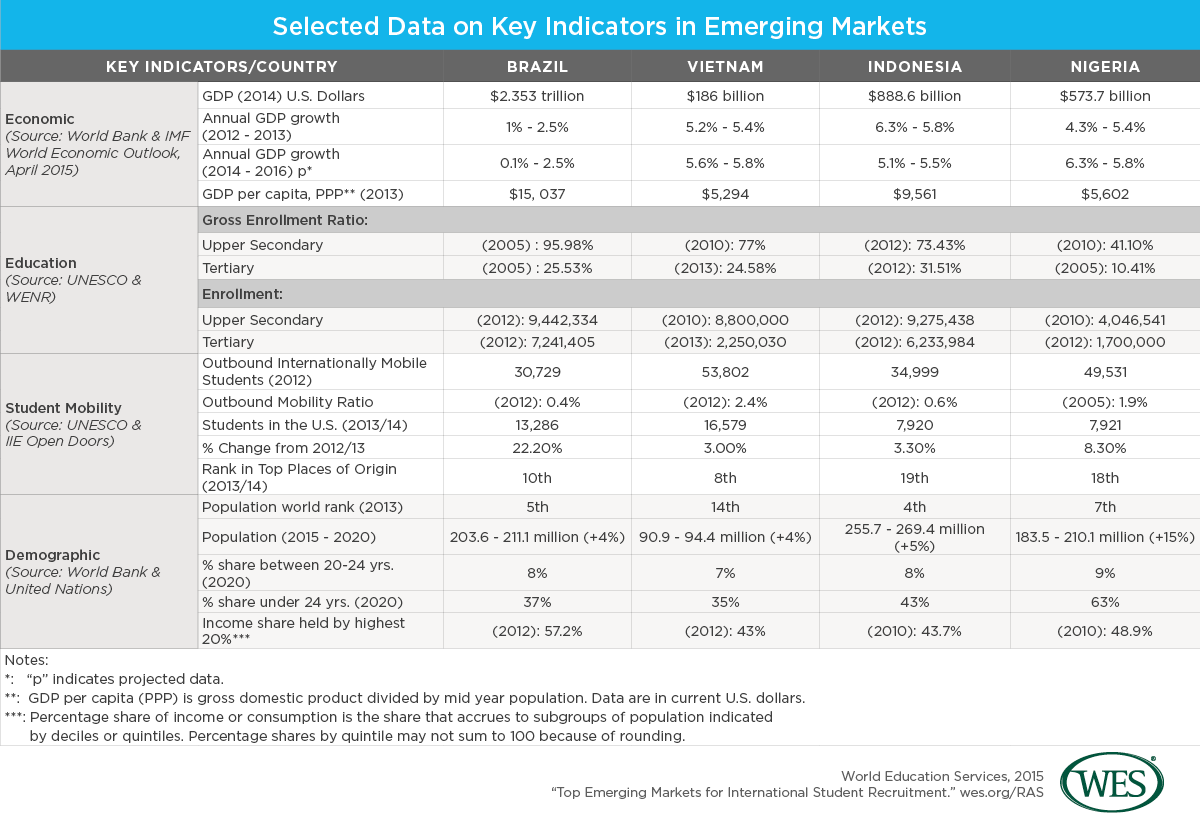

Brazil has been one of the most promising markets for international student recruitment for the past few years due to its large population, strong economy, and the effective Brazil Scientific Mobility Program (BSMP). According to IIE Open Doors data (2013/14), the number of Brazilians studying in the U.S. last year increased 22.2 percent versus the year prior. There were 13,286 Brazilian students in the U.S.in 2014, and of those, 38.3 percent were enrolled at the undergraduate level and 23.5 percent at the graduate level. Approximately one-fifth (22 percent) were studying in science, technology, engineering, and mathematics (STEM) fields, and one-fifth (21.1 percent) were studying business/management.

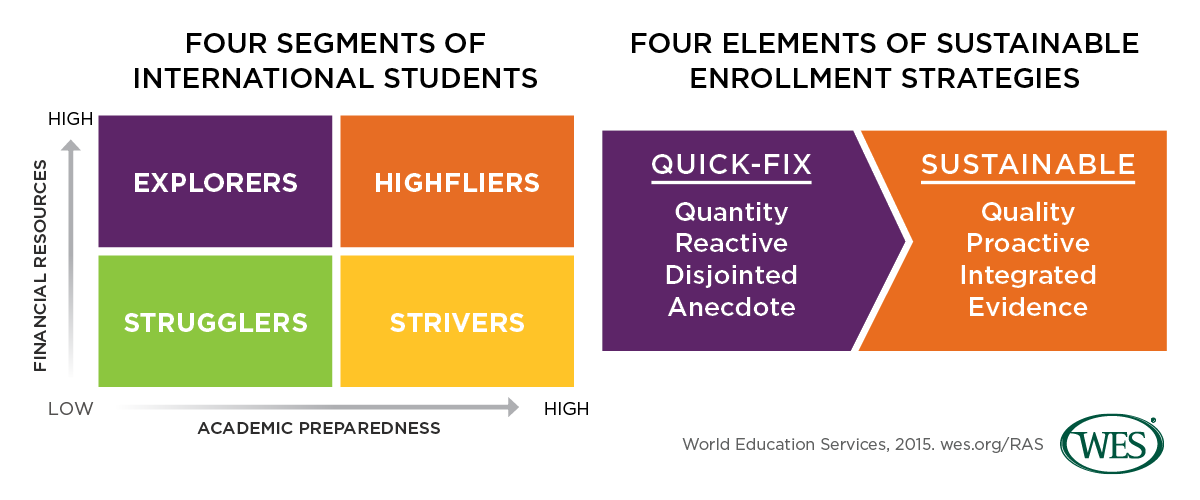

Government and scholarship programs are key in the decision-making process of many Latin American students. Since the introduction of the BSMP in 2011, the number of Brazilian students in the U.S. has steadily increased. Brazilian President Dilma Rousseff has announced that the federal government will provide an additional 100,000 BSMP scholarships between 2015 and 2018 at both the undergraduate and graduate levels. The program is currently in its second phase and will be placing an added focus on graduate students who have won awards in national math, physics, and chemistry competitions in Brazil. In addition, students must obtain a merit standard of 600 points on the ENEM (the national high school exam) in order to qualify. According to WES’ segmentation framework of international students, we believe that U.S. higher education institutions (HEIs) will welcome more ‘Highflier’ graduate students from Brazil – those with strong financial resources and high academic preparedness – within the next three years.

Not only is this good for the diversity of international student bodies, but also for U.S. universities looking to collaborate with Brazilian partners. Sarah Rodriguez, formerly Assistant Director of International Student Admissions and Orientation at Indiana Institute of Technology, found that a partnership with the Institute of International Education (IIE), which administers BSMP in the U.S., brought a large number of short-term Brazilian students to the university. She also pointed to the benefits of enrolling Brazilian graduate assistants and representatives who are able to forge good relationships and build connections with specific universities in Brazil. Effectively engaging in partnerships with local government, universities, and the ministry of education will build pipelines through which U.S. institutions can recruit and retain Brazilian students into the future.

The use of popular social media sites and messaging services such as Facebook and WhatsApp have also proven to be effective recruitment tools, as they allow admissions professionals to connect with students in groups as well as on an individual basis. As social media and networking platforms differ by country, seeking advice from current international students is a good first-step to understanding effective ways to penetrate country-specific social networks before actively beginning recruitment campaigns.

2. Vietnam

As identified in WES’ previous Emerging Markets report, Vietnam is and remains an important recruitment market, with outbound mobility growing significantly over the past 13 years. In 2013/14, there were 16,579 Vietnamese students studying in the U.S., making Vietnam the eighth-ranked nation among all sending countries. With steady growth in both the number of students arriving from Vietnam and also in the size of the country’s economy, Vietnam looks set to continue as a strong growth market. Vietnam’s economic growth will also enable parents from its growing middle class to send their children to study in the U.S. at a younger age. An increasing pool of Vietnamese secondary-school graduates in the U.S. also represents an emerging and significant recruitment channel for HEIs.

However, Vietnam is a country still in transition, and issues of affordability still persist. Today, approximately 90 percent of Vietnamese students overseas are self-funded. Although the country’s GDP per capita (PPP) has increased in recent years, the number is still projected to remain below $7,000 by 2020, which is considerably less than that of most developing nations. As a result, many Vietnamese students choose to study at more affordable community colleges in the U.S.; these students constituted 7.4 percent (6,509) of the total international student body at community colleges in 2013/14. Indeed, more than half of Vietnamese tertiary-level students in the U.S. are enrolled in community colleges, making Vietnam the third-ranked place of origin after China and South Korea.

Institutions that wish to enroll more Vietnamese undergraduate students should consider promoting scholarship and financial aid opportunities. Vietnamese students tend to be academically well prepared, but they often lack financial resources. Ann Rahmat1, who has served as a Senior Assistant Director for International Recruitment at Miami University, said that on average, Vietnamese students at her school are able to pay approximately $20,000 per annum on average. They are attracted by merit-based scholarships, which help to compensate for the remaining costs of attendance. Though some experts have also commented that Vietnamese students’ financial conditions are better than those of students from other countries in the Southeast Asian region, identifying local scholarship programs within Vietnam as well as designing and communicating their own scholarship programs could help institutions attract more international students from Vietnam.

Some of the recruitment professionals interviewed for the study have made many high school visits to Vietnam, finding it to be a highly effective method of recruitment, especially as relates to creating brand awareness. They also found that smaller cities (in terms of population) like Hanoi offered them more prospective students than bigger cities like Ho Chi Minh City. Another promising and cost-effective method of recruitment is for universities to partner with other U.S. universities when planning recruitment trips, such that they can reach out to secondary schools directly in Vietnam and explain the potential benefits of earning a four-year degree through transfer arrangements between community colleges and universities.

As a word of caution, as more and more agents are coming under public scrutiny, institutions should be cautious when using agents to recruit students from Vietnam.

3. Indonesia

Indonesia is a notable emerging market and is recognized as one of the world’s most significant emerging economies due to its rapid GDP growth and large population. A 2012 report from McKinsey & Company notes that by 2030, Indonesia’s economy is predicted to become the seventh largest in the world. As with many developing countries, a growing economy often corresponds with growth in educational spending. Indeed, the number of Indonesian students has increased in China, Malaysia, and Japan, since those countries offer affordable quality education and scholarships for international students.

As a price-sensitive country, Indonesian enrollment volume in the U.S. declined until 2010/11 from 2000/01, despite a one-year increase in 2007/08. However, Indonesian enrollment is now slowly but steadily bouncing back. In 2013/14, there were 7,920 Indonesian students in the U.S., the highest number in ten years. According to the United Nations Population Division, by 2015, the Indonesian undergraduate population (those aged between 20 and 24 years old) will constitute nearly 8 percent of the total population (20.46 million), and the share will remain the same through 2020. Currently, the majority of Indonesian students in the U.S. (68.4 percent) are undergraduates. The most popular areas of study are STEM fields (31.8 percent).

International admissions experts interviewed for the study found it effective to use digital lead purchases (e.g., e-mails) and social media marketing to attract undergraduate students from Indonesia. Jacqueline Vogl, Assistant VP of Global Education at SUNY Plattsburgh, works with a data solutions company to utilize e-mail marketing and to send promotional materials to students who took standardized exams such as the TOEFL and SAT. From this practice, they were able to compile an e-mail list of prospective students based on open and click-through rates, which showed where their brand message was resonating most.

Although the use of social media for international recruitment is still new compared to its use for domestic recruitment, data show that there are nearly 69 million Facebook users in Indonesia, most of whom are young people; the number is expected to reach 97.5 million by 2018. Therefore, an effective use of social media strategy is key in reaching prospective students from Indonesia.

4. Nigeria

In 2014, Nigeria was the largest economy in Africa and it is a rising star on the U.S. higher education scene. A booming economy has resulted in a stable flow of Nigerian students to institutions in the U.S. and elsewhere. The U.S. is currently the second-most popular destination for Nigerian students after the United Kingdom.

The generally poor quality of Nigeria’s domestic higher education system and increasing demand from middle- and high-income Nigerian families who can afford to send their children overseas means that recruiting prospects from the West African nation look set to remain strong.

According to the most recent IIE Open Doors report, Nigerian student enrollment in the U.S. has increased more than 25 percent in the past five years. In 2013/14, there were 7,921 Nigerian students studying here. Half (50.9 percent) of Nigerian students in the U.S. are enrolled at the undergraduate level; nearly two-fifths (35 percent) of students are at the graduate level and more than half (56.8 percent) are STEM majors.

Overall, the international admissions experts interviewed for our study noted that Nigerian students tend to be quite proficient in English as it is the official language of the country. Those at the undergraduate level are often academically well prepared, especially in science-related subject areas. Nigerian students are mainly concentrated in the ‘Highflier’ and ‘Striver’ segments. Strategically developing better scholarship packages will attract more students from Nigeria. In addition, if institutions have a history of enrolling high quality Nigerian students and retaining a good alumni base, our experts suggested that engaging alumni in recruiting and starting student ambassador programs could be useful.

Like Vietnam, agencies and education fairs in Nigeria seem to be drawing scrutiny. Based on our interviews with admissions experts, we found that connecting with international schools in Nigeria is one of the best practices for undergraduate recruitment. They prefer this method over others, as it offers direct communication with high school students and counselors. Furthermore, it is a cost-effective way to reach out to prospective students, as opposed to study tours organized by government agencies.

Diversify Target Countries and Recruiting Practices

Diversifying international student populations on university campuses, many of which have limited budgets and information resources, is a complex challenge that requires sustainable international student enrollment strategies. To maximize institutional resources and achieve recruitment goals, U.S. institutions are encouraged to investigate the different segments of international students and to adopt a portfolio approach to recruiting.

In building a portfolio of countries from which to recruit, we recommend that institutions focus their near-term recruitment efforts on Brazil, Vietnam, Indonesia, and Nigeria, in addition to the traditional markets. A more targeted approach can help institutions save time and effort when looking toward emerging markets.

Institutions should cultivate and implement multi-pronged international student recruitment and enrollment strategies based on students’ unique needs. Adopting a portfolio of practices based on evidence-based enrollment strategies can help U.S. institutions better understand students from emerging markets. It can also reduce risk and maximize enrollment opportunities. It is important to “zoom out” and look at the big picture when it comes to emerging markets, including economic and education indicators, and then to “zoom in” to understand the students’ profiles and needs in each unique context.

1. Ann Rahmat is currently the Director of International Recruitment and Global Engagement at Missouri Western State University.